Loan providers often divide the information that comprises a debt-to-income ratio into separate groups called ratio that is front-end back-end ratio, before you make your final choice on whether or not to expand home financing loan.

The front-end ratio just considers financial obligation directly regarding a home loan re re payment. It’s determined by the addition of the mortgage repayment, homeowner’s insurance coverage, real-estate fees and property owners aociation charges (if relevant) and dividing that by the month-to-month earnings.

As an example: If month-to-month mortgage repayment, insurance coverage, fees and charges equals $2,000 and month-to-month income equals $6,000, the ratio that is front-end be 30% (2,000 split by 6,000).

Loan providers wish to start to see the ratio that is front-end of% or le for old-fashioned loans and 31% or le for Federal Housing Aociation (FHA) loans. The higher the portion, the greater danger the lending company is using, plus the much more likely a higher-interest price would be reproduced, in the event that loan had been given.

Back-end ratios would be the ditto as debt-to-income ratio, meaning they consist of all financial obligation linked to mortgage repayment, plus ongoing month-to-month debts such as for instance bank cards, automotive loans, figuratively speaking, son or daughter help re payments, etc.

Why Ratio that is debt-to-Income Things

Because there is no legislation developing a definitive debt-to-income ratio that requires loan  providers to produce a loan, there are a few accepted requirements, particularly since it regards federal mortgages.

providers to produce a loan, there are a few accepted requirements, particularly since it regards federal mortgages.

for instance, if you be eligible for a VA loan, Department of Veteran Affairs instructions suggest a maximum 41% debt-to-income ratio. FHA loans will provide for a ratio of 43%. It’s poible to obtain a VA or FHA loan with an increased ratio, but only once you can find compensating factors.

The ratio necessary for main-stream loans differs, according to the loan company. Many banking institutions depend on the 43% figure for debt-to-income, however it could possibly be up to 50%, dependent on facets like earnings and credit card financial obligation. Bigger loan providers, with big aets, are more inclined to accept customers by having an income-to-debt that is high, but as long as they will have your own relationship utilizing the consumer or think there clearly was enough income to pay for all debts.

Keep in mind, evidence reveals that the higher the ratio, the much more likely the debtor will probably have dilemmas spending.

Is My Ratio Too that is debt-to-Income Tall?

The lower your debt-to-income ratio, the greater your economic condition. You’re most likely doing okay when your debt-to-income ratio is gloomier than 36%. Though each situation is significantly diffent, a ratio of 40% or more can be an indication of a credit crisis. As your financial obligation payments decrease as time passes, it will cost le of the take-home pay on interest, freeing up cash for any other spending plan priorities, including cost savings.

What exactly is a Debt-to-Income Ratio?

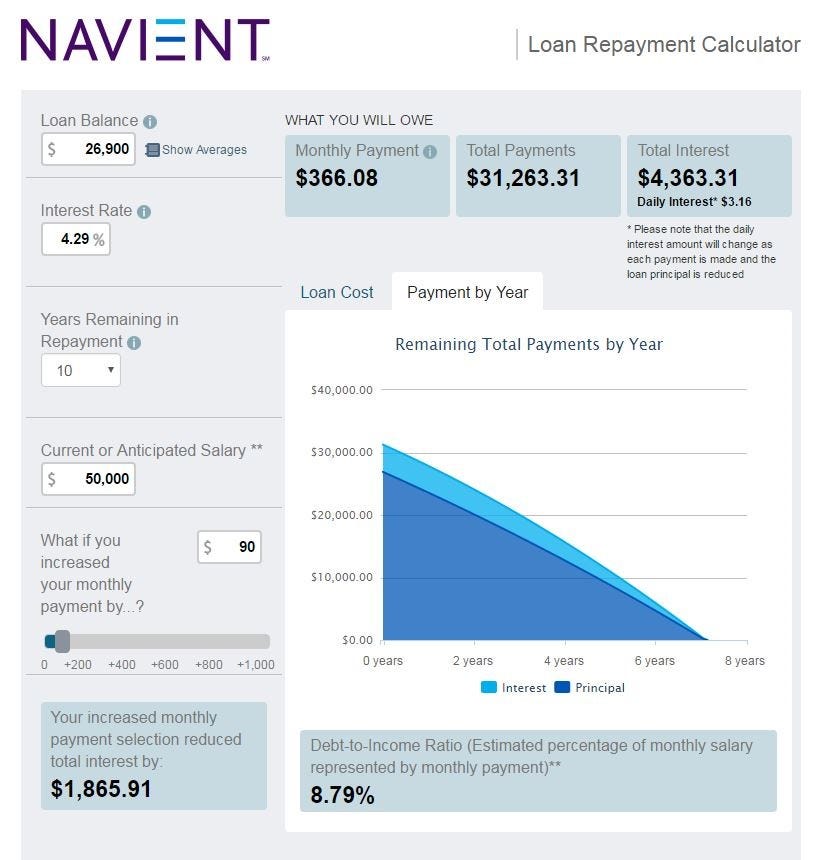

Debt-to-income ratio (DTI) may be the number of your total debt that is monthly split by the amount of money you will be making per month. It allows loan providers to look for the chance as you are able to manage to repay that loan.

As an example, in the event that you spend $2,000 30 days for home financing, $300 30 days for a car loan and $700 four weeks for the bank card stability, you have got a complete month-to-month financial obligation of $3,000.

When your gro income that is monthly $7,000, you divide that in to the financial obligation ($3,000 /$7,000), along with your debt-to-income ratio is 42.8%.

Many loan providers need your debt-to-income ratio to be under 36%. Nevertheless, it is possible to get a” that is“qualified (one which satisfies specific borrower and loan provider requirements) with a debt-to-income ratio because high as 43%.

The ratio is most beneficial figured for a month-to-month foundation. For instance, in case your month-to-month take-home pay is $2,000 and also you spend $400 each month with debt re re payment for loans and charge cards, your debt-to-income ratio is 20 % ($400 split by $2,000 = .20).

Place another real method, the ratio is a portion of one’s earnings this is certainly pre-promised to debt re payments. That means you have pre-promised 40% of your future income to pay debts if your ratio is 40.

What exactly is a Good Debt-to-Income Ratio?

There isn’t a one-size-fits-all answer in terms of exactly just just what is really a debt-to-income ratio that is healthy. Instead, this will depend on a variety of facets, as well as your life style, goals, income degree, work security, and threshold for economic danger.